The Best Of Being A First Time Home Buyer

Being A First Time Home Buyer

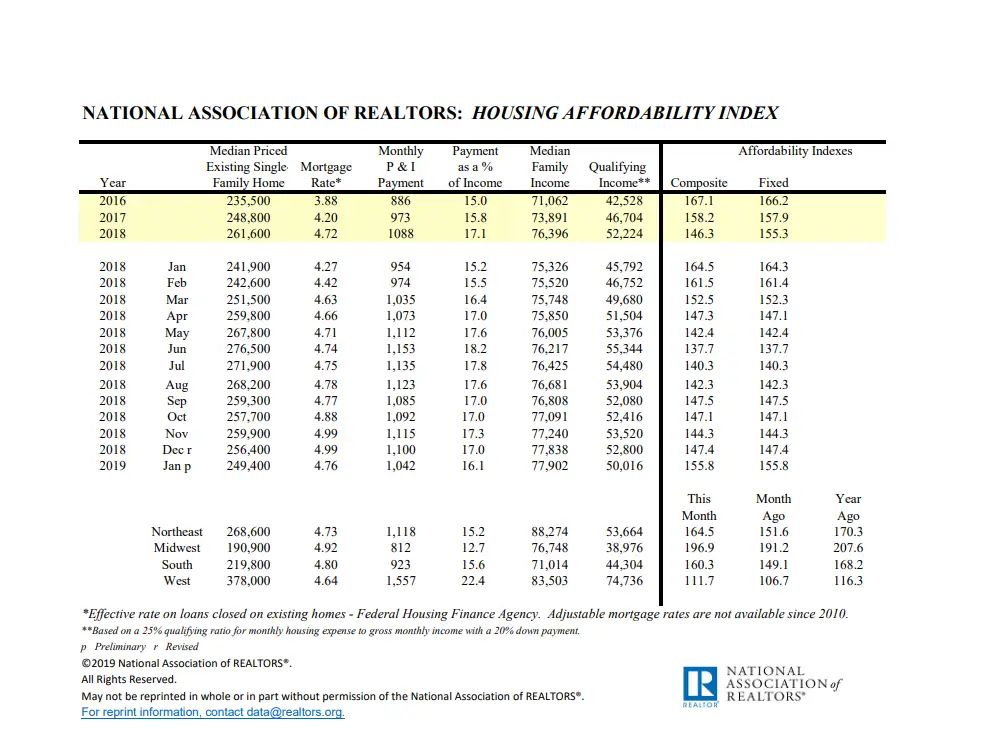

There are various sorts of mortgages available, to individuals, depending on their requirements. Not all mortgages have the same interest rate for the life span of the loan and monthly payments change regularly. Before you commit to any mortgage, don’t forget to ask about all of the closing expenses. The very first mortgage applied for falls in the class of the first mortgage when going in for a different mortgage on precisely the same property is what’s known as a second mortgage. If it comes to fixed rate mortgages, you can qualify for a loan term of either 15 or 30 years and sometimes a 40-year loan term given.

[wpl_widget_instance id=”wpl_carousel_widget-15″]

Because there are several kinds of mortgages to pick from, the mortgaging companies are continuously competing to keep the rates flexible to entice maximum buyers. So remember to read the small print, and always make sure you ask about the redemption penalties and the typical rate length of the mortgage you’re obtaining. It is wise to have a fixed-rate mortgage in the event the mortgage interest prices are rising.

A mortgage involves the total amount of the loan as well as the interest. It is a loan that is paid back over a set time. Since the second mortgage usually calls for a greater associated rate of interest.

If you’re taking a mortgage out for the property, then you ought to be ready to pre-pay the very first year of the homeowner’s insurance too. For the very first time homebuyers, there are many mortgages to pick from, depending upon their financial conditions. A fixed mortgage is essentially a mortgage that has the very same interest rate for the life span of the loan. During times of rising market rates of interest, it’s preferable for borrowers to opt for a fixed rate mortgage.

Home Buying at a Glance

The mortgage rate is the rate of interest on a home loan. Mortgage interest rates help determine the borrower’s choice of mortgage to a reasonable extent. When purchasing property, the rate of interest on a mortgage will play a critical role in how much you will need to pay monthly. It is suggested to go for adjustable mortgage rates when there’s a downward fluctuation in the interest prices. Therefore, the long-term fixed mortgage rates protect borrowers from any upward volatility in mortgage interest prices.

If your fixed rate on your house is lower than current market prices, you can decide to get merely a second loan instead. Finding low interest rates for a very first time home buyer revolves around the credit history of the person seeking the financial loan, locating a good co-signer, and accumulating a hefty down payment to decrease the complete money borrowed. Now is time to start looking into which type of interest rate you desire to pay. Since the rate of interest remains fixed, you’re saved from paying higher rates according to market fluctuations. Ask the lender what you could do as a way to receive that lower rate of interest.

Why Almost Everything You’ve Learned Is Wrong

In light of all of the mortgage issues throughout the last few decades, it highlights why home buyers should shop around for interest prices. The very first time home buyer may also use at least one of several down payment assistance programs which will help with the down payment on the property buy. First time home buyers frequently have a chance to get completely free money and other discounts on their mortgage that the majority of people don’t know about.

At the moment, buyers ought to be out there buying! Most first time home buyers have zero notion of where to start. In summary, they should still focus on price because it will always be an important part of the real estate transaction. Add in the tax credit you’ve got an unbelievable opportunity if you’re a first time home buyer. Being Impatient First time home buyers have a tendency to be quite inpatient in trying to find a home.

If buyers had a better comprehension of interest rates, it could have significantly cut back on mortgage fraud over the past few years. First-time buyers should check their credit ratings and correct any problems before applying for financing. All home buyers have to understand a few critical tips until they buy a house for the very first moment. The first time they have plenty of reasons to start looking to buy a new home. Of course, whenever you’re a first time home buyer, you make every attempt to avoid being deceived. Today the very first time home buyer is in a great position. You also are looking for the ideal mortgage broker.

1 Trackback