When it comes to buying a house, there is no one-size-fits-all answer. What’s right for one person might not be the best choice for another. Some general tips and guidelines can help you make the best decision for you and your family. This guide will walk you through buying a house, from start to finish. It’ll explain everything you need to know, from finding the right home to getting financing to moving in.

Calculate How Much Home You Really Can Afford

There are many factors that go into determining the monthly payment of a home when you are buying a house. Some of the most critical ones to consider include the home’s purchase price, any type of mortgage rate offered, and any other associated fees incurred during the home buying process.

Another factor that may be relevant is your income and credit history. If you have a high income or a good credit score, you may qualify for lower interest rates or fewer upfront fees, ultimately reducing your monthly payment.

Whether you are a first-time homebuyer or an experienced buyer looking for a new home, consider these factors when determining your monthly payment.

By doing so, you can be confident in making the best decision for your specific financial situation.

Most real estate websites offer a quick calculator that can give you a rough estimate of the monthly payment.

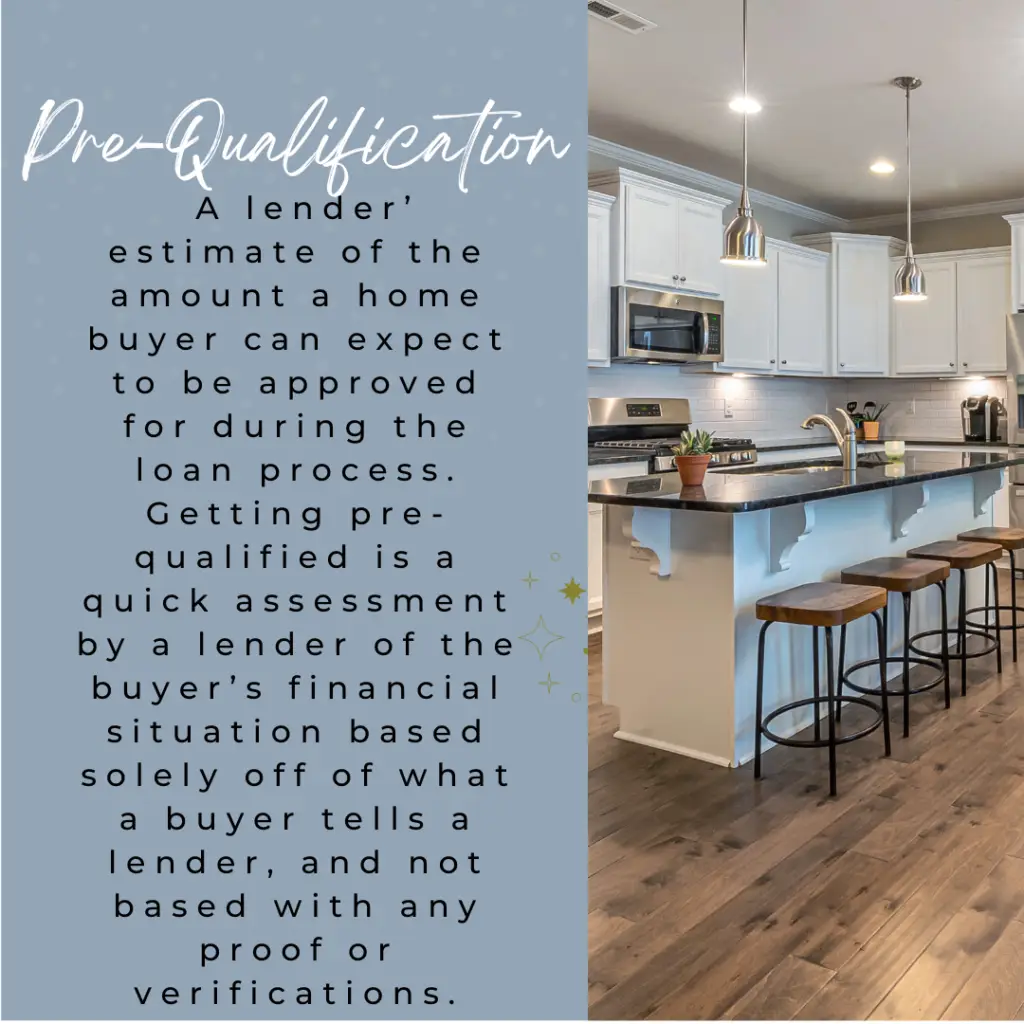

The Pre-Qualification Process

The homeownership process begins with a mortgage pre-qualification, which gives you an idea of how much money you can borrow to buy a house.

To get pre-qualified, you’ll need to provide your lender with information about your income, assets, and debts. Once your lender has this information, they’ll use it to calculate your debt-to-income (DTI) ratio.

This ratio is used to determine whether you’re likely to be able to afford the monthly mortgage payments. If your DTI ratio is too high, you may not be able to get pre-qualified for a loan.

In addition to calculating your DTI ratio, your lender will also look at your credit score. This number is used to measure your creditworthiness and is one of the biggest factors that lenders consider when approving a loan.

Though your credit score is just one factor in determining whether or not you’ll be approved for a mortgage, it is a major factor. Lenders will use your credit score to get an idea of your financial history and to determine how likely you are to make your payments on time.

A higher credit score will usually result in a lower interest rate, which can save you thousands of dollars over the life of your loan. You’ll need a credit score of at least 620 to qualify for a conventional home loan, though some lenders may require a higher score.

If you’re looking to buy a house with a government-backed loan, such as an FHA loan, you’ll need a minimum credit score of 580. With so much riding on your credit score, you should take steps to improve it if it’s not where you want it to be.

You can start by paying all of your bills on time and keeping your debt levels low. Making these changes can take time, but they’ll be worth it when you’re ready to buy your dream home.

The Down Payment

Most home buyers will need to make a down payment in order to purchase a home. The down payment size will vary depending on the type of mortgage loan used.

For example, conventional home loans typically require a down payment of 5%. However, if the home buyer puts down 20%, they may be able to avoid paying private mortgage insurance (PMI).

Veterans who are using a VA loan may be able to put down as little as $1. Talk to a lender to learn what type of down payment is required for the particular loan program you are interested in.

Creating a Features List

When buying a home, be mindful of your specific needs and wants. Before you start looking at potential properties, take some time to sit down and create a list of factors that are important to you.

For example, do you need plenty of square footage for your family, or are smaller homes more suitable? Do you prefer a quiet neighborhood, or do you like somewhere that is more active?

Additionally, consider other factors like the home’s layout and indoor/outdoor space. Once your list is complete, use it as a guide when viewing potential homes. This will help you narrow down which properties best fit you and your family, making the search process easier and more efficient.

Most buyers start with the total number of bedrooms, bathrooms, and a primary feature such as “single story.” Then, they add “wish-list” items such as a pool, RV parking, or a big backyard.

Once you have an idea of your must-have and nice-to-have features, you can search for homes that fit your criteria.

Making an Offer on a House

When making an offer on the house, there are a few key things that you should keep in mind. First, you need a solid understanding of the current market conditions in your area.

Knowing what comparable homes are selling for can help you to determine how aggressively you can negotiate with the seller. You should also prepare thoroughly before presenting your offer, taking note of any red flags or repairs that may affect the property’s value and determining how flexible you are willing to be on closing costs or other fees.

Your real estate agent can help guide you on the property’s market value, who generally pays for what, and if you should ask for concessions.

If you are working with a buyer’s agent, they will typically handle most of the paperwork and negotiations involved in making an offer.

If you see something in the home that you like, and it’s not permanently attached to the property, ask for it in writing with your offer.

This includes things like window treatments, appliances, and even furniture.

The seller may be willing to leave these items behind if they are not particularly attached to them, and it can save you money on these items down the road.

Once you have made an offer on the house, the seller will accept, reject, or counter your offer.

If they counter your offer, you can choose to accept, reject, or counter their counteroffer. This back-and-forth negotiation will continue until both parties come to an agreement or one party decides to walk away from the deal.

You are under no obligation to accept any offer made by the seller, so be sure to consult with your agent to determine if the price is fair before deciding.

The Mortgage Process

After finding the perfect home and calculating how much you can afford to pay each month, it’s time to apply for a mortgage loan.

The first step in this process is to get pre-approved by a lender. The lender will review your financial information and give you a letter stating how much they are willing to lend you.

Getting pre-approved for a loan can help you better understand your price range and allow you to start shopping for homes in your price range.

Once you have found a home that you would like to make an offer on, the next step is to get a mortgage loan.

The Home Appraisal

A home appraisal is when a professional appraiser assigned by the bank comes to determine the market value of the home you are buying. The appraiser will look at many factors, including the home’s size, the home’s age, any recent renovations, the location of the house, and comparable homes in the area.

The appraiser will also consider any special features of the home that might increase its value, such as a swimming pool or a finished basement. Once the appraiser has completed their evaluation, they will provide you with a report detailing their findings.

If the home’s appraised value is less than the purchase price, you may need to negotiate to lower the price with the seller. If you are still unable to reach an agreement, you may have to cancel the deal altogether.

The home appraisal is a key step in the mortgage process as it protects both the buyer and the lender from paying more for the property than it is worth.

Home Inspections

During a home inspection, the buyer’s inspector will closely look at all aspects of the property to assess its condition and identify any potential issues. They will begin by inspecting the home’s exterior, looking for signs of wear and damage that may have been caused by weather or pests.

Once inside, they will check for problems with wiring, plumbing, other major systems, and any structural flaws that could lead to water damage or mold growth. In addition, they will examine areas such as the attic and basement for leaks or moisture intrusion.

Finally, they will review any existing documentation related to the property’s past repairs or updates to understand its history better. Overall, their primary goal is to provide buyers with all of the information they need to make an informed decision about whether or not to move forward with the purchase.

Negotiating Repairs

When it comes to buying a house, one of the most vital aspects is ensuring that everything is in good working condition. Whether it’s water damage, faulty electrical wiring, or a crumbling foundation, any significant problems with the property can drastically impact the cost and ease of the home purchase. One of the most crucial tasks for a buyer is to communicate openly and effectively about potential repairs with their realtor and sellers.

Come into a home-buying negotiation prepared with a clear understanding of what needs to be fixed and what would be considered cosmetic versus necessary repairs. Most buyers use the report provided by the home inspector.

Next, be sure to prioritize your list so that you can negotiate based on importance and magnitude, rather than starting out trying to address all issues at once. Finally, keep in mind that negotiation is an art as much as it is a science. While logic may dictate specific terms when discussing repairs, consider your feelings during these conversations to create more favorable outcomes overall.

The seller will most often offer to repair the requested items or may offer a credit at closing, which the buyer can use to make the repairs themselves after taking ownership. If you reach an impasse, it may be necessary to hire a professional contractor to provide an estimate for the cost of repairs.

This will give you more ammunition when going back to the negotiating table, as the seller will clearly understand how much it would cost to fix the issues in question.

The Closing Process

Closing a property transaction generally happens about 30 to 45 days after signing the contract. This gives the buyer time to arrange for their mortgage and the seller time to move out of the property.

Before closing, the buyer will need to have their mortgage loan in order and will likely need to provide a down payment (typically 20% of the purchase price).

The closing process involves signing a stack of documents related to the property, including the mortgage, deed, and various disclosures.

After all of the paperwork is signed, the down payment is made, and the deed is recorded, the keys to the property will be given to the buyer, and you will officially become the new owner!

Buying a house is a significant life milestone, and you should approach the process with caution and care. By working with a qualified real estate agent, getting a professional home inspection, and being prepared to negotiate repairs, you can ensure that you’re getting the best possible deal on your new home.

Most importantly, remember to take your time and enjoy the process. After all, a house is more than just an investment – it’s somewhere to build memories that will last a lifetime.