The Ultimate Guide to Buying a House in Fulshear, Texas: Insights from Stacy Burgin with Terra Point Realty

Are you considering buying a house in Fulshear, Texas? Look no further, as we bring you the ultimate guide to buying a house in Fulshear. Also, help you navigate the exciting journey of purchasing your dream home in this charming city. In this blog post, we’ve collaborated with Stacy Burgin, a seasoned real estate professional from Terra Point Realty, to provide you with invaluable insights and expert advice. So, let’s dive in and discover everything you need to know about the ultimate guide to buying a house in Fulshear, Texas!

Secondly, buying a house in Fulshear, Texas, can be an exciting venture, especially given the area’s unique blend of small-town charm and proximity to major urban centers like Houston. Here’s a comprehensive guide to help you navigate the home-buying process in Fulshear.

Why Choose Fulshear?

Fulshear offers a variety of appealing features for potential homeowners:

Small-Town Charm with City Convenience:

Fulshear provides a quaint, country atmosphere while being conveniently close to Houston, offering easy access to city amenities such as shopping, dining, and professional services.

Growing Real Estate Market:

The real estate market in Fulshear is booming with a wide range of housing options, from affordable new constructions to luxurious estates. This growth presents investment opportunities and a dynamic market for potential homeowners.

High-Quality Education:

The city is served by highly-rated school districts like Katy ISD and Lamar Consolidated ISD. Therefore, making it an attractive location for families.

Natural Beauty and Recreational Opportunities:

Fulshear is surrounded by beautiful landscapes and offers ample recreational activities, including hiking and biking.

Proximity to Employment Opportunities:

The city’s location near major employment centers, including Houston’s Energy Corridor, makes it convenient for professionals.

Understanding Fulshear's Housing Market

Fulshear, nestled in Fort Bend County, offers a serene suburban lifestyle with a touch of Texas charm. Stacy Burgin, a trusted realtor with Terra Point Realty, explains that Fulshear’s housing market is thriving, making it an ideal location for homebuyers. With picturesque landscapes, excellent schools, and a strong sense of community, Fulshear has become a sought-after destination for families and professionals alike.

Steps to Buying a Home in Fulshear

Define Your Priorities:

Determine what you need in a home, such as the number of bedrooms, proximity to schools, and community amenities.

Research Neighborhoods:

Explore Fulshear’s diverse neighborhoods to find one that suits your lifestyle and budget. In addition, Fulshear offers a variety of neighborhoods, each with its unique characteristics and amenities. Stacy Burgin recommends researching the different neighborhoods in Fulshear to find the one that aligns with your lifestyle and preferences. Whether you’re looking for a family-friendly community or a serene retreat, Fulshear has something to offer everyone.

Work with a Knowledgeable Realtor:

A local realtor can provide valuable insights into the market and help you find the right home. Additionally, navigating the real estate market can be overwhelming, especially for first-time buyers. Stacy Burgin emphasizes the importance of working with an experienced realtor who understands the intricacies of Fulshear’s housing market. A knowledgeable realtor will guide you through the entire home-buying process, from finding listings to negotiating offers and closing the deal.

Determine Your Budget

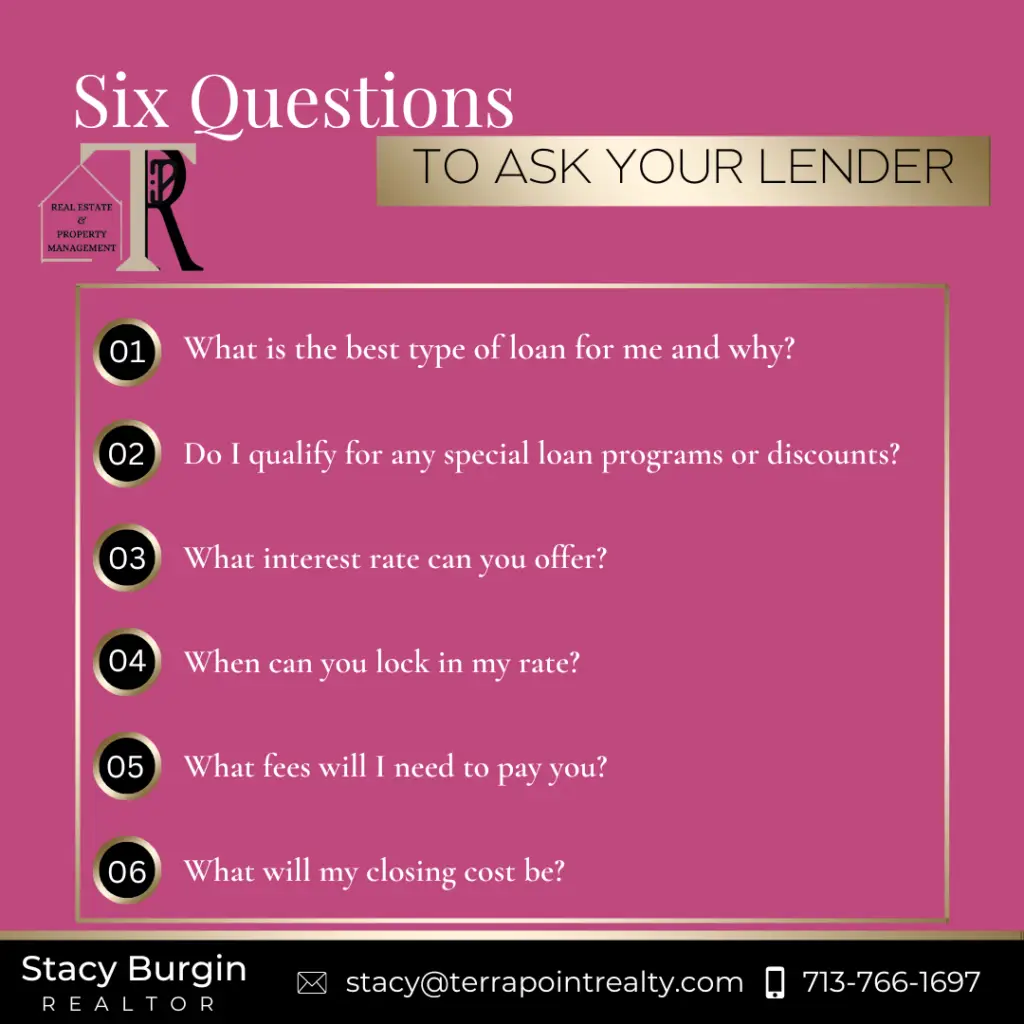

Assess your financial situation to understand how much you can afford. Consider upfront costs like earnest money, option fees, and closing costs. Additionally, before embarking on your home-buying journey, it’s essential to assess your finances and establish a budget. Stacy Burgin advises potential buyers to consult with a mortgage lender to determine the loan amount they qualify for. This step will help you understand your price range and narrow down your search for the perfect home in Fulshear.

Calculate How Much Home You Really Can Afford:

There are many factors that go into determining the monthly payment of a home when you are buying a house. Some of the most critical ones to consider include the home’s purchase price, any type of mortgage rate offered, and any other associated fees incurred during the home buying process.

Another factor that may be relevant is your income and credit history. If you have a high income or a good credit score, you may qualify for lower interest rates or fewer upfront fees, ultimately reducing your monthly payment.

Whether you are a first-time homebuyer or an experienced buyer looking for a new home, consider these factors when determining your monthly payment.

By doing so, you can be confident in making the best decision for your specific financial situation.

Most real estate websites offer a quick calculator that can give you a rough estimate of the monthly payment.

The Pre-Qualification Process:

The homeownership process begins with a mortgage pre-qualification. Therefore, which gives you an idea of how much money you can borrow to buy a house.

To get pre-qualified, you’ll need to provide your lender with information about your income, assets, and debts. Once your lender has this information, they’ll use it to calculate your debt-to-income (DTI) ratio.

DTI Ratio:

This ratio is used to determine whether you’re likely to be able to afford the monthly mortgage payments. If your DTI ratio is too high, you may not be able to get pre-qualified for a loan.

In addition to calculating your DTI ratio, your lender will also look at your credit score. Furthermore, this number is used to measure your creditworthiness. Moreover, is one of the biggest factors that lenders consider when approving a loan.

Though your credit score is just one factor in determining whether or not you’ll be approved for a mortgage. However, it is a major factor. Lenders will use your credit score to get an idea of your financial history. Also, to determine how likely you are to make your payments on time.

A higher credit score will usually result in a lower interest rate. Therefore, which can save you thousands of dollars over the life of your loan. You’ll need a credit score of at least 620 to qualify for a conventional home loan. Though some lenders may require a higher score.

If you’re looking to buy a house with a government-backed loan, such as an FHA loan, you’ll need a minimum credit score of 580. With so much riding on your credit score, you should take steps to improve it if it’s not where you want it to be.

You can start by paying all of your bills on time and keeping your debt levels low. Making these changes can take time, but they’ll be worth it when you’re ready to buy your dream home.

The Down Payment

Most home buyers will need to make a down payment in order to purchase a home. The down payment size will vary depending on the type of mortgage loan used.

For example, conventional home loans typically require a down payment of 5%. However, if the home buyer puts down 20%, they may be able to avoid paying private mortgage insurance (PMI).

Veterans who are using a VA loan may be able to put down as little as $1. Talk to a lender to learn what type of down payment is required for the particular loan program you are interested in.

Creating a Features List

When buying a home, be mindful of your specific needs and wants. Before you start looking at potential properties, take some time to sit down and create a list of factors that are important to you.

For example, do you need plenty of square footage for your family, or are smaller homes more suitable? Do you prefer a quiet neighborhood, or do you like somewhere that is more active?

Additionally, consider other factors like the home’s layout and indoor/outdoor space. Once your list is complete, use it as a guide when viewing potential homes. This will help you narrow down which properties best fit you and your family, making the search process easier and more efficient.

Most buyers start with the total number of bedrooms, bathrooms, and a primary feature such as “single story.” Then, they add “wish-list” items such as a pool, RV parking, or a big backyard.

Once you have an idea of your must-have and nice-to-have features, you can search for homes that fit your criteria.

Tour Homes and Make an Offer

Visit homes with your realtor and make an offer on a property that meets your needs. Be prepared to negotiate terms with the seller. Furthermore, once you’ve identified your preferred neighborhoods, it’s time to start viewing homes. Stacy Burgin advises buyers to make a checklist of their must-haves and nice-to-haves, helping them stay focused during the viewing process. When you find the perfect home, your realtor will assist you in making a competitive offer and negotiating the terms with the seller.

Making an Offer on a House:

When making an offer on the house, there are a few key things that you should keep in mind. First, you need a solid understanding of the current market conditions in your area.

Knowing what comparable homes are selling for can help you to determine how aggressively you can negotiate with the seller. You should also prepare thoroughly before presenting your offer, taking note of any red flags or repairs that may affect the property’s value and determining how flexible you are willing to be on closing costs or other fees.

Your real estate agent can help guide you on the property’s market value, who generally pays for what, and if you should ask for concessions.

If you are working with a buyer’s agent, they will typically handle most of the paperwork and negotiations involved in making an offer.

If you see something in the home that you like, and it’s not permanently attached to the property, ask for it in writing with your offer.

This includes things like window treatments, appliances, and even furniture.

The seller may be willing to leave these items behind if they are not particularly attached to them, and it can save you money on these items down the road.

Once you have made an offer on the house, the seller will accept, reject, or counter your offer.

If they counter your offer, you can choose to accept, reject, or counter their counteroffer. This back-and-forth negotiation will continue until both parties come to an agreement or one party decides to walk away from the deal.

You are under no obligation to accept any offer made by the seller, so be sure to consult with your agent to determine if the price is fair before deciding.

Get Pre-Approved for a Mortgage

Secure a pre-approval letter from a lender to strengthen your offer when you find a home you like. This is often a requirement from sellers.

The Mortgage Process:

After finding the perfect home and calculating how much you can afford to pay each month, it’s time to apply for a mortgage loan.

The first step in this process is to get pre-approved by a lender. The lender will review your financial information and give you a letter stating how much they are willing to lend you.

Getting pre-approved for a loan can help you better understand your price range and allow you to start shopping for homes in your price range.

Once you have found a home that you would like to make an offer on, the next step is to get a mortgage loan.

The Home Appraisal

A home appraisal is when a professional appraiser assigned by the bank comes to determine the market value of the home you are buying. The appraiser will look at many factors, including the home’s size, the home’s age, any recent renovations, the location of the house, and comparable homes in the area.

The appraiser will also consider any special features of the home that might increase its value, such as a swimming pool or a finished basement. Once the appraiser has completed their evaluation, they will provide you with a report detailing their findings.

If the home’s appraised value is less than the purchase price, you may need to negotiate to lower the price with the seller. If you are still unable to reach an agreement, you may have to cancel the deal altogether.

The home appraisal is a key step in the mortgage process. As it protects both the buyer and the lender from paying more for the property than it is worth.

Conduct a Home Inspection

Hire a reputable home inspector to evaluate the property for any issues. Use this information to negotiate repairs or adjustments to the sale price if necessary. However, before finalizing the purchase, it’s crucial to conduct inspections and due diligence to ensure the property meets your expectations. Stacy Burgin recommends hiring a professional inspector to assess the home’s condition, including its structure, electrical systems, plumbing, and more. This step helps identify any potential issues and gives you the opportunity to negotiate repairs or adjustments with the seller.

Home Inspections:

During a home inspection, the buyer’s inspector will closely look at all aspects of the property to assess its condition and identify any potential issues. They will begin by inspecting the home’s exterior. For example, looking for signs of wear and damage that may have been caused by weather or pests.

Once inside, they will check for problems with wiring, plumbing, other major systems, and any structural flaws that could lead to water damage or mold growth. In addition, they will examine areas such as the attic and basement for leaks or moisture intrusion.

Finally, they will review any existing documentation related to the property’s past repairs or updates to understand its history better. Overall, their primary goal is to provide buyers with all of the information they need to make an informed decision about whether or not to move forward with the purchase.

Close the Deal

Once all conditions are met, finalize the purchase by signing the necessary paperwork and transferring funds. Lastly, the final step in buying a house in Fulshear is the closing process. Stacy Burgin explains that this involves signing the necessary paperwork, transferring funds, and officially becoming the owner of the property. Your realtor will guide you through this process, ensuring a smooth and stress-free closing experience.

Financing and Assistance

Mortgage Options:

Compare mortgage rates from various lenders to find the best deal. Consider both fixed-rate and adjustable-rate mortgages.

First-Time Home Buyer Programs:

If you’re a first-time buyer, explore programs offered by the Texas State Affordable Housing Corporation (TSAHC) for down payment assistance and mortgage credit certificates.

Conclusion

In conclusion, buying a home in Fulshear, Texas, offers numerous benefits. Such as, including a high quality of life, excellent schools, and a promising real estate market. Therefore, by following these steps in the ultimate guide to buying a house in Fulshear and working with local experts, you can find your dream home in this charming community.

Furthermore, buying a house in Fulshear Texas, is an exciting endeavor. Also, with the guidance of Stacy Burgin from Terra Point Realty, you can navigate the process with confidence. Such as, from understanding the housing market to closing the deal. This ultimate guide provides you with the knowledge and insights needed to make your dream of homeownership in Fulshear a reality. Happy house hunting!

Contact Information

To schedule a coffee date or learn more about the ultimate guide to buying a house in Fulshear Texas, contact Terra Point Realty at 713-766-1697. Their friendly and knowledgeable team is ready to assist you with the ultimate guide to buying a house in Fulshear Texas. Don’t miss out on the opportunity to live in your dream house – schedule a coffee date today and start your journey towards the ultimate guide to buying a house in Fulshear Texas.