Housing Affordability Stressing Out Buyers

With inventory at multi-year lows in many markets and home prices increasing; now is the time to act. Consumers need to be careful not to stretch their budgets too far; as that can lead to an overextended mortgage. One that is larger than what they can afford. Which can lead to a loss of equity if the home is sold. Consumers also need to be cognizant of their monthly housing costs. Can be reduced by getting the best rate on their mortgage; by making sure their insurance policy is the right fit for their needs.

According to National Association of Home Builders data; that marks the highest share since before the pandemic. Mortgage rates above 5% alone are pressing on more budgets; since the beginning of the year, mortgage rates have jumped 1.8 points, adding about $400 average monthly payment to median-priced houses, according to NAR data.

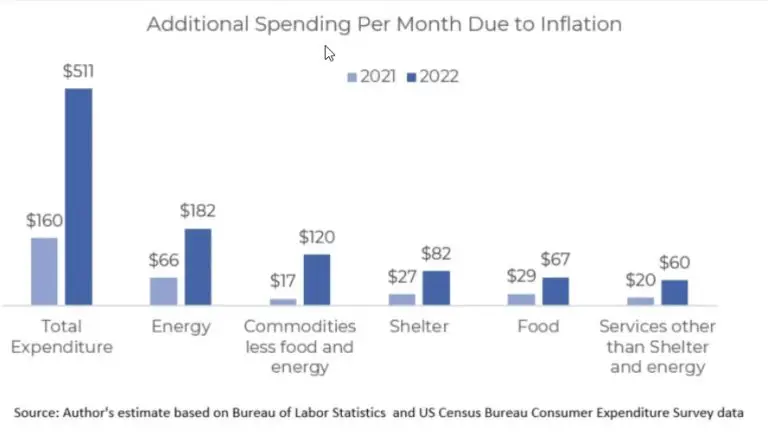

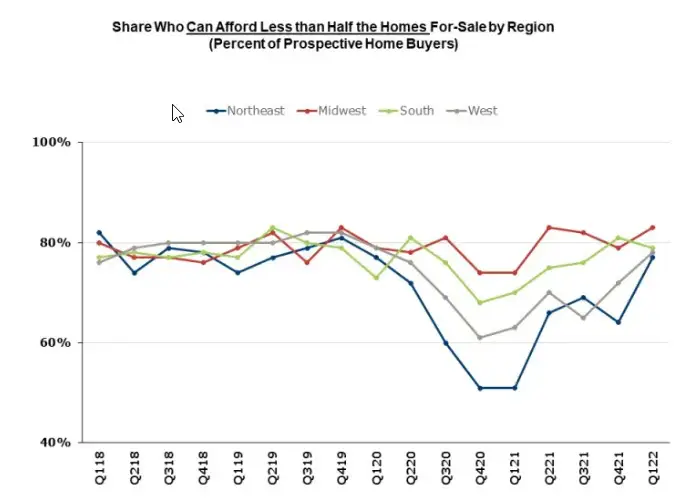

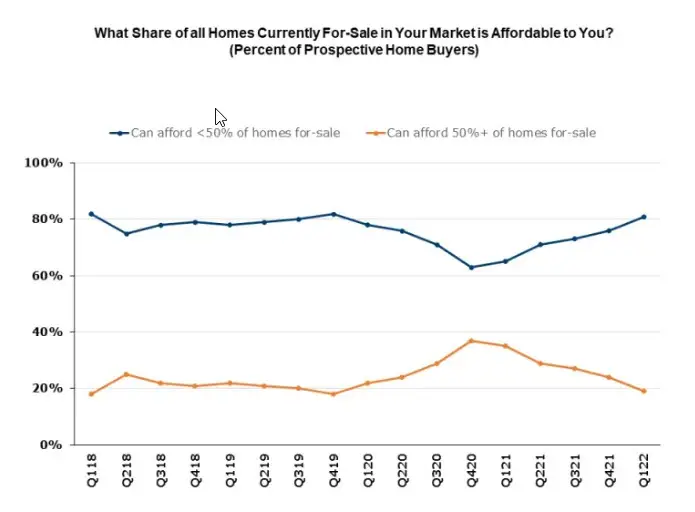

The average American is spending $500 more a month on living expenses than they would have a year ago. Thanks to 40-year high inflation. House hunters should be looking for homes around $40,000 cheaper than they might have been just 12 months ago due to the rising costs. Home prices continue to rise all over the country; so this isn’t easy. In March, the median home price was $375,300 and 15% higher than last year. Housing affordability expectations are dropping since 2020’s final quarter,). According to NAHB data – buyers who can only afford less than half of what’s available in their area increased from 51% (Northeast), 74% (Midwest), 68% (South), and 61%)(West).

Home Searches

Home searches are getting more brutal, and consumers realize that. Only 17% of buyers expect their home search to be more accessible in the months ahead. Which is lower than its previous level in 2018. “Buyers’ worsening perceptions of housing availability reflect the record-levels output levels of available inventory,” Rose Quint writes for NAHB’s Eye on Housing blog.

1 Trackback