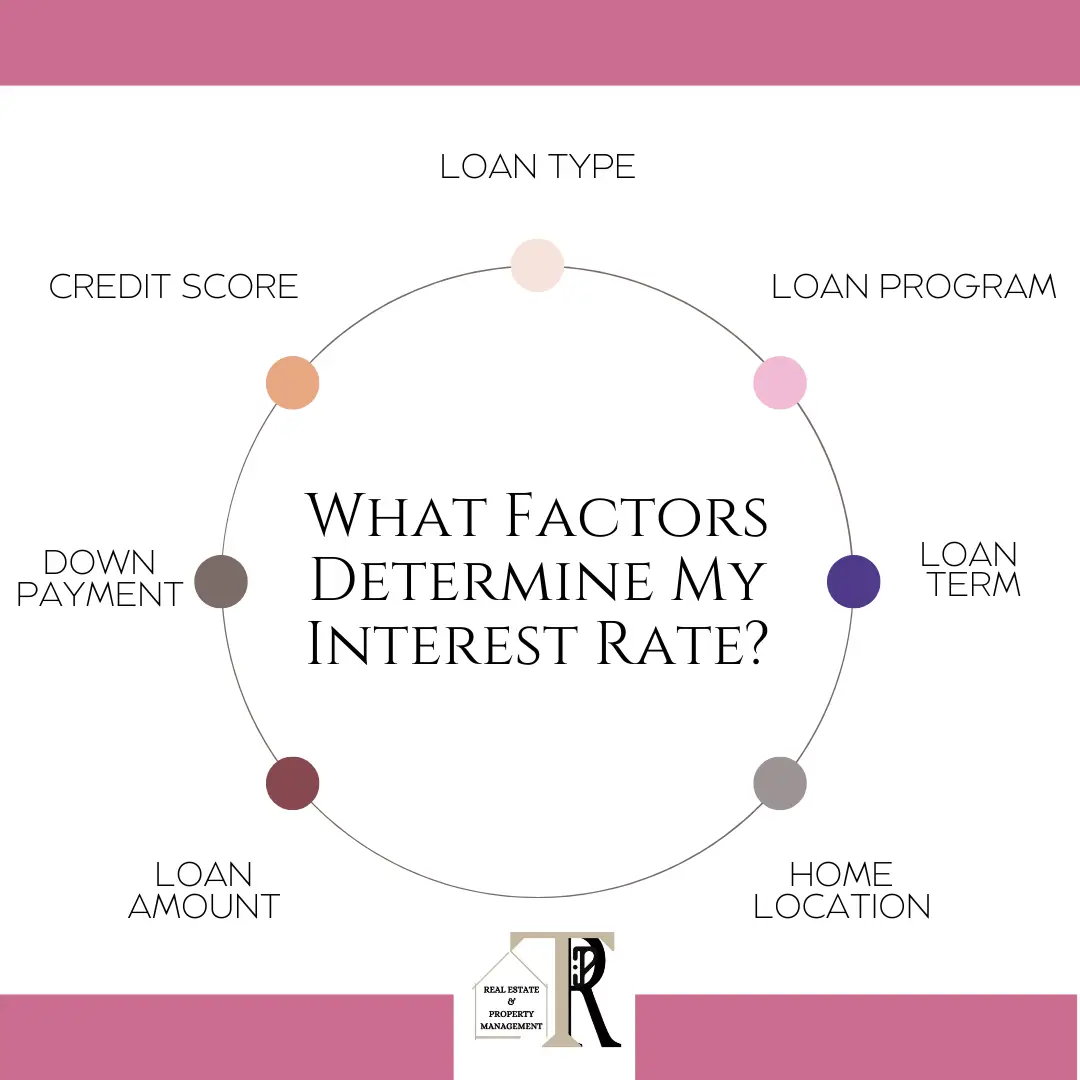

Determine Your Mortgage Interest Rate

The interest rate on your mortgage is determined by a combination of personal and market factors. Therefore, determining your mortgage interest rate involves considering a range of personal and market-related factors. Hence, these factors come together to shape the rate you will be offered and ultimately affect the cost of your home loan. In brief, here’s a detailed breakdown of these factors:

Personal Factors

1. Credit Score

First, your credit score is one of the most significant factors affecting your mortgage rate. As a rule, higher credit scores generally lead to lower interest rates because they indicate to lenders that you are a lower-risk borrower nerdwallet.com . For instance, borrowers with credit scores of 740 or higher often receive the lowest rates nerdwallet.com.

2. Down Payment

The size of your down payment also impacts your mortgage rate. Therefore, a larger down payment can result in a lower interest rate as it decreases the loan-to-value ratio (LTV), reducing the lender’s risk experian.com. Moreover, this is because a substantial down payment shows the lender that you have more at stake in the property.

3. Debt-to-Income Ratio (DTI)

Lenders evaluate your DTI ratio, which is the percentage of your gross monthly income that goes towards paying debts. Such as, a lower DTI ratio suggests a better balance between debt and income, potentially leading to lower mortgage rates TheMortgageReports.com.

4. Loan Amount and Type

The amount you borrow and the type of mortgage (e.g., fixed-rate, adjustable-rate, FHA, VA) can affect your rate. For example, larger loan amounts or loans that are perceived as riskier (like adjustable-rate mortgages) might carry higher rates experian.com.

Market Factors

1. Economy

General economic conditions including inflation, employment rates, and GDP growth influence mortgage rates. Typically, stronger economic conditions push interest rates higher due to increased borrowing capacity and vice versa BusinessInsider.com .

2. Federal Reserve Policies

The Federal Reserve’s actions on short-term interest rates indirectly influence mortgage rates. When the Fed raises its rates, mortgage rates tend to follow, reflecting changes in borrowing costs across the economy Investopedia.com.

3. Bond Market

Mortgage rates are closely tied to the bond market, particularly the yields on U.S. Treasury notes. When bond yields rise, mortgage rates generally increase RocketMortgage.com.

4. Housing Market Conditions

The demand and supply in the housing market can also affect mortgage rates. Such as, lower demand for mortgages can lead to lower rates, and vice versa Investopedia.com.

5. Secondary Market

Mortgage-backed securities (MBS) and how they perform in the secondary market also play a role. For example, if investors demand higher yields on these securities, mortgage rates may rise Investopedia.com.

Determine Your Mortgage Interest Rate | Additional Considerations

Loan Term:

Shorter loan terms typically have lower interest rates compared to longer terms. In any case, because they represent a shorter risk period for the lender experian.com.

Interest Rate Type:

Fixed-rate mortgages offer stability as the rate remains the same throughout the loan term, whereas adjustable-rate mortgages (ARMs) may start with a lower rate that can change based on market conditions ConsumerFinance.gov.

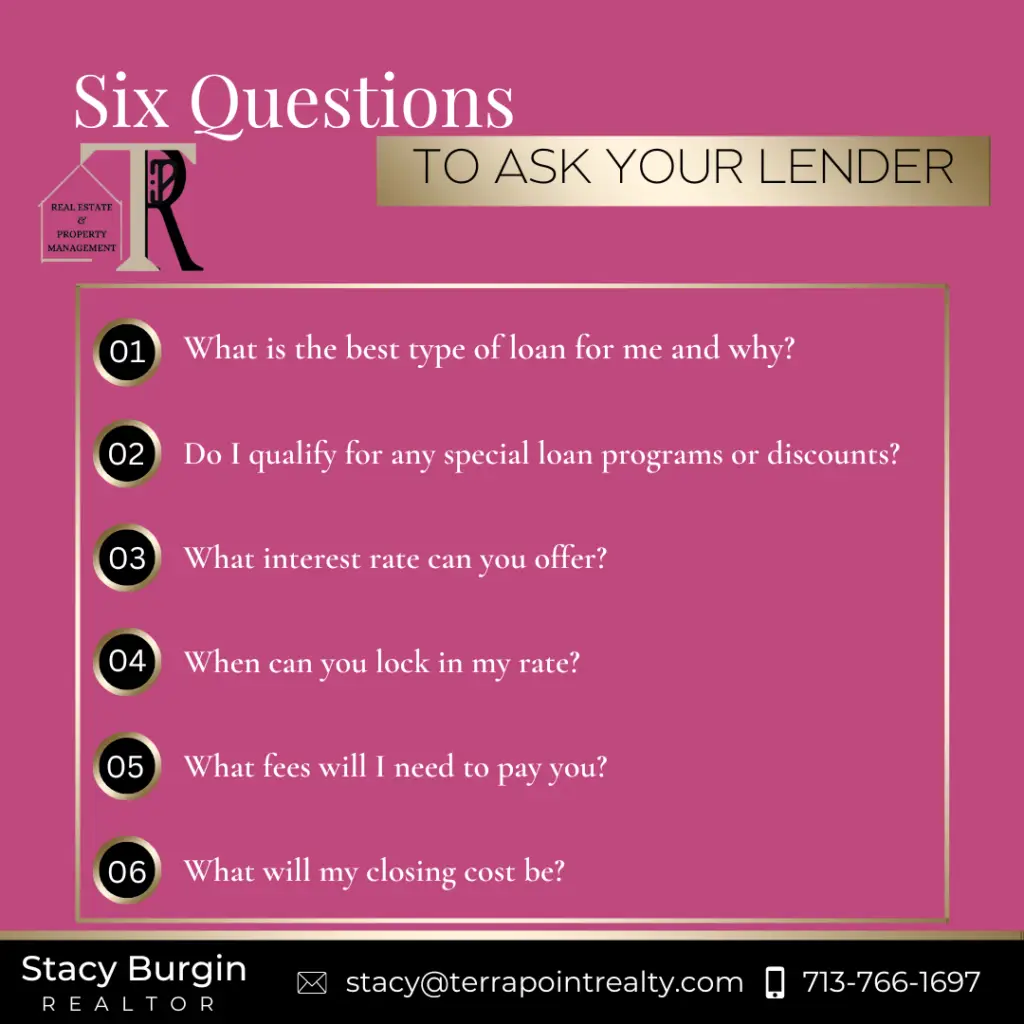

In conclusion, understanding these factors can help you better prepare for mortgage shopping, allowing you to potentially secure a more favorable interest rate. Remember, each lender may weigh these factors differently, so it’s beneficial to shop around and compare offers from multiple lenders BusinessInsider.com.

Contact Information

To schedule a coffee date or learn more about what factors determine your mortgage interest rate, contact Terra Point Realty at 713-766-1697. Their friendly and knowledgeable team is ready to assist you with what factors determine your mortgage interest rate. Don’t miss out on the opportunity to live in your dream house – schedule a coffee date today and start your journey towards what factors determine your mortgage interest rate.