How to Improve Your Credit Score for a Lower Mortgage Rate

To start, if you’re looking how to improve your credit score in order to secure a lower mortgage rate. Thus, there are a few key strategies you can implement. Firstly, make sure to pay all your bills on time and in full every month. As this demonstrates responsible financial management. Secondly, reducing your credit card utilization by paying down outstanding balances can also have a positive impact on your credit score. Lastly, regularly monitoring your credit report for errors or discrepancies and addressing them promptly can help ensure that your credit profile is accurate and up-to-date. Moreover, by following these steps, you’ll be well on your way to improving your credit score and securing a lower mortgage rate. Here’s a comprehensive guide on how to achieve this:

Review Your Credit Reports

Start by obtaining your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You can do this for free once a year at AnnualCreditReport.com. Review these reports carefully to ensure there are no errors or inaccuracies. If you find any discrepancies, dispute them immediately with the respective credit bureau Bankrate.com.

Pay Bills On Time

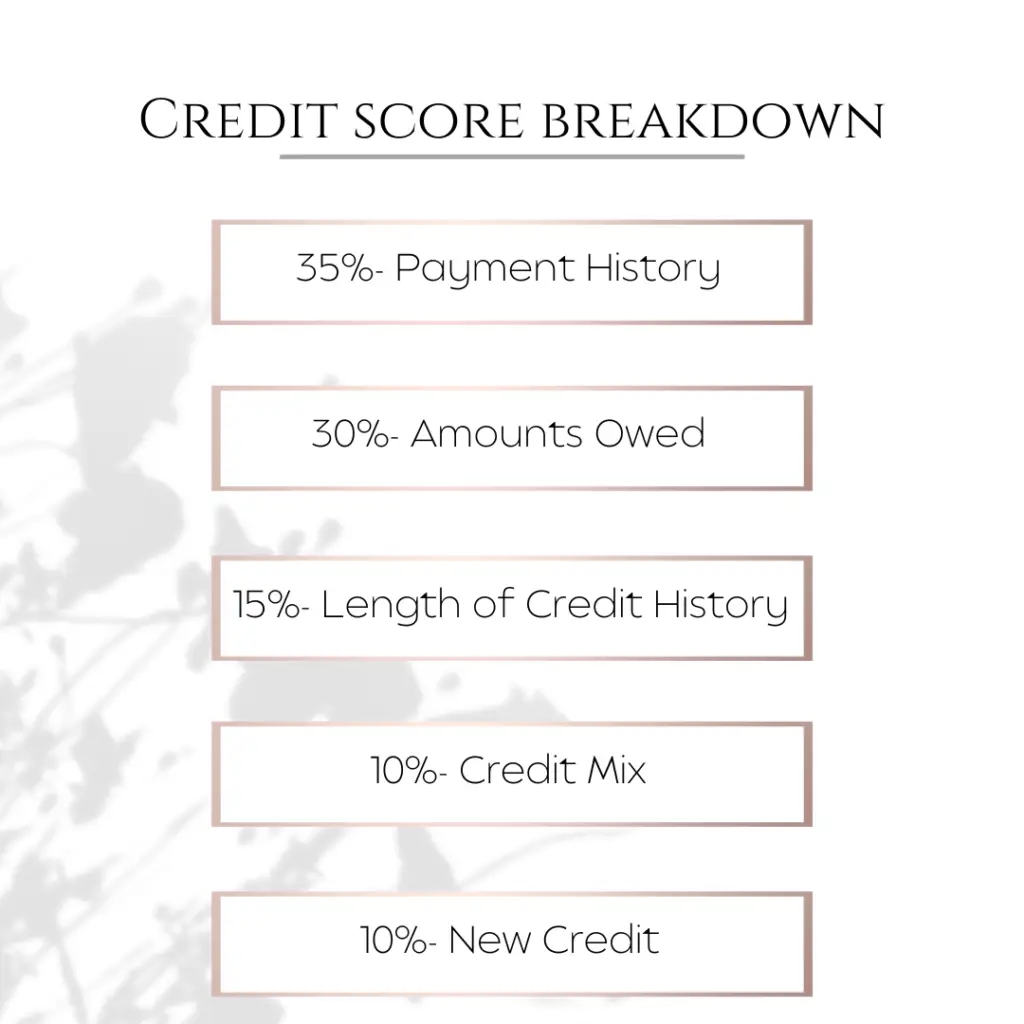

Your payment history is the most significant factor affecting your credit score, accounting for 35% of your FICO score CNN.com. Set up payment reminders or automate your payments to ensure you never miss a due date. Consistently paying your bills on time can significantly improve your credit score over time Equifax.com.

Reduce Credit Card Balances

The amount you owe, especially on revolving credit like credit cards, heavily influences your credit score. Aim to keep your credit utilization ratio—the percentage of your credit limit you use—below 30%. Paying down your balances not only improves your utilization rate but also boosts your credit score experian.com.

Avoid New Credit Applications

Each time you apply for credit, a hard inquiry is made, which can temporarily lower your credit score. Limit the number of new credit applications, particularly in the months leading up to your mortgage application creditkarma.com.

Increase Credit Limits

If you have credit cards, consider requesting a credit limit increase from your issuers. For example, higher credit limits can reduce your credit utilization ratio, provided you do not increase your spending creditkarma.com.

Diversify Your Credit Mix

Having a mix of credit types, such as credit cards, student loans, and a car loan, can positively affect your credit score. This shows lenders that you can manage different types of credit responsibly. However, it’s important not to take on debt unnecessarily just to diversify your credit Equifax.com.

Become an Authorized User

You might consider becoming an authorized user on a family member’s credit card account, especially if they have a strong payment history and low credit utilization. This can add positive information to your credit report creditkarma.com.

Regularly Monitor Your Credit

Keep track of your credit score and report changes. Many financial institutions and credit card companies offer free credit monitoring services. Regular monitoring can help you understand how your actions affect your score and allow you to adjust your credit behavior accordingly creditkarma.com.

Address Delinquencies

If you have any delinquent accounts or collections, focus on paying these off as soon as possible. A history of paying off past debts can be beneficial to your credit score Equifax.com.

How to Improve Your Credit Score for a Lower Mortgage Rate | Conclusion

In conclusion, by following these steps, you can improve your credit score, which can lead to securing a lower mortgage rate. Remember, improving your credit score is a process that requires patience and consistency. The effort you put into managing your credit responsibly will pay off with better loan terms and lower interest rates.

Contact Information

To schedule a coffee date or learn more about how to improve your credit score for a lower mortgage rate, contact Terra Point Realty at 713-766-1697. Their friendly and knowledgeable team is ready to assist you with how to improve your credit score for a lower mortgage rate. Don’t miss out on the opportunity to live in your dream house – schedule a coffee date today and start your journey towards how to improve your credit score for a lower mortgage rate.